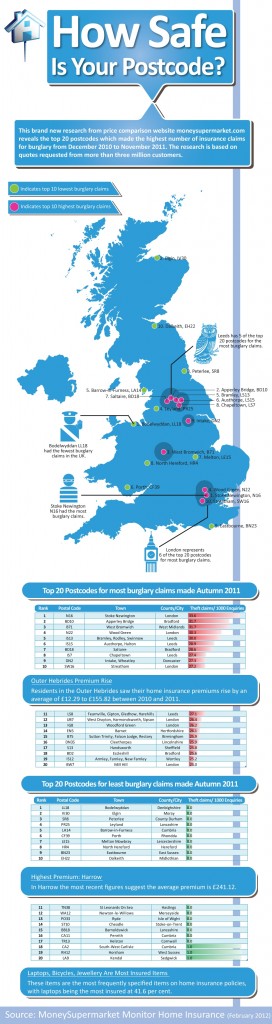

New research by Moneysupermarket.com has identified the places in the UK where householders are most likely to claim on their home insurance policy due to being burgled or being the victim of theft.

Perhaps not surprisingly, the dubious honour of the worst burglary hotspot goes to London and the Stoke Newington area in the north of the city. The N16 postcode saw nearly 34 people in every 1000 making a theft-related insurance claim.

With statistics such as these, it’s no surprise that customers who have recently searched for a moneysupermarket contents insurance quote, will be keen to properly protect their belongings and get a cost-effective and competitive price for their premium.

In joint second place were the postcodes B71, in West Bromwich in the Midlands and BD10, which covers the upmarket Apperley Bridge area of Bradford. Both had nearly 32 claims per 1000 people. Leeds and London have the most entries in the most burglary prone postcodes, but no areas in Scotland or Wales made it into the top 20.

The research was conducted using data from three-million home insurance quotes gathered on the site and covers the period from December 2010 to November 2011.

For the insurance companies, various factors, including the burglary rate in a particular postcode, are considered when they are working out how much to charge you for your policy.

There was better news, however, for people living at the opposite end of the burglary risk scale. The survey showed seventeen places where you are least likely to be burgled. They included Heston in Cornwall, Elgin in Moray and Peterlee in County Durham, which all recorded less than one claim per 1000 people.

If the burglary hotspot research does show that you live in an at-risk area, then you may want to take measures to upgrade the security of your home. However, wherever you live it’s important to protect your property from burglars and make it as difficult as possible for them to gain access to your home (including your garden, shed or garage) and take your belongings.

A few simple measures, such as having security lights and installing effective door and window locks, can all help to deter thieves from choosing your property to break into. A Neighbourhood Watch scheme is also a good idea – you could join an established one or, if none exists in your area, set one up.

Make sure you have adequate contents cover in place by accurately calculating the value of your possessions, just in case the worst does happen and you are burgled. You may need to update the policy if you buy new high-value items and you might also need additional cover for items that are regularly taken out of the home, such as jewellery or laptops.